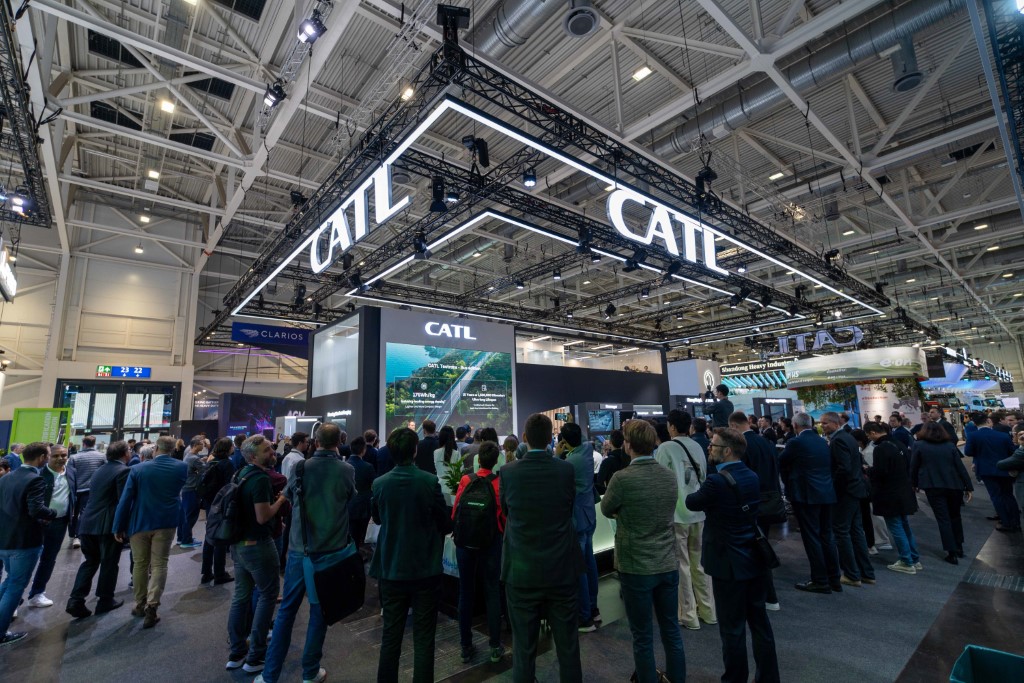

CATL shares soar on outlook for battery sales

By BLOOMBERG | 29 August 2025

SHENZHEN: Chinese battery maker Contemporary Amperex Technology Co. Ltd.'s shares jumped to the highest in three years after a supplier indicated a strong outlook for sales.

Its Shenzhen-listed shares surged by as much as 14% to the highest since August 2022.

Equipment supplier Wuxi Lead Intelligent Equipment Co., which said that it was expecting intensive capacity expansion among key clients, saw its own shares surge 20%.

Wuxi Lead is a major supplier of manufacturing equipment for battery makers, including CATL, and is an important indicator of the industry outlook.

That makes its positive comments suggestive of a fresh wave of investment in battery production.

Wuxi Lead's management is negotiating orders for 2026 and early 2027 with key accounts and "expecting intensive and consistent capacity expansion comparable with last upcycle," Morgan Stanley analysts led by Sheng Zhong wrote in a note.

Other Chinese battery manufacturers also rallied, with Gotion High-Tech Co. and Eve Energy Co. shares climbing.

CATL has long dominated the global battery market.

In the first-half of this year, its share stood at 37.9%, according to SNE Research, comfortably ahead of second placed BYD Co. with 17.8% and winning market share from major rivals in South Korea and Japan.

The Ningde, Fujian-based company posted a record second-quarter profit, defying shaky global demand for EVs, with its outlook further buoyed by a blockbuster share sale in Hong Kong aimed at fueling its expansion.

Beyond its operations at home, CATL now has wholly-owned production basis in Germany and Hungary and is building a joint venture with automaker Stellantis NV in Spain.

Wuxi Lead "would likely know CATL's expansion plan," and also mentioned progress in solid-state batteries, said Kelvin Lau, an analyst at Daiwa Capital Markets Hong Kong Ltd.

CATL has a goal of small-scale solid-state battery production by 2027.

Tags

Autos CATL

Reviews

First drive with the 2025 Hyundai Tuscon and Santa Fe: Seoul...

5.8

Kymco AK550 Premium: Smart easy rider

BYD Seal 6 Premium: Sweet deal, generous kit, sensible prici...

8.7

Mazda CX-80 2.5G PHEV AWD High Plus: Upmarket upgrade

Proton X50 Flagship: Tuned for success

6.6

Triumph Trident 660: Beautifully balanced package

8.4

Mercedes-AMG GLA 35 4Matic: Never a dull moment

Lamborghini Urus SE: Ultimate control

Videos

Free & Easy Media Test: Latest Proton X50 Flagship to Kuanta...

Zeekr Space Sunway City Video

Honda Civic Type R Ultimate Edition: Last 40 Units for Europ...