DETROIT: BorgWarner Inc’s attempt to garner more respect from investors for its effort to shift to electrification fell flat, triggering an 8% slide in the auto-parts maker’s shares on the day it presented its strategic vision.

The Detroit-area based company gave a three-hour presentation Tuesday, making a case that it’s just as prepared for the move to electric cars as the vehicle assemblers it has longed supplied, including Ford Motor Co., General Motors Co. and Volkswagen AG.

Shares of those automakers each soared more than 30% this year through Tuesday, based in part on aggressive plans to sell more EVs. BorgWarner was up less than half that amount - and fell to US$44.30 Tuesday, the steepest drop since June.

“People have really asked the question: Is BorgWarner really positioned to succeed as the world shifts more dramatically towards electrification?” chief financial officer kevin Nowlan said in an interview.

“That’s exactly what today’s strategy is intended to address.”

The leading manufacturer of turbochargers for gasoline-powered vehicles is preparing to make the leap to the era of electrics. Ford and VW together account for about 24% of its sales, according to supply-chain data compiled by Bloomberg.

“Investors believe BWA is still playing ‘catch-up,’” Chris McNally, an analyst at Evercore ISI with an in-line rating on the stock, wrote in a research note published Wednesday.

Ryan Brinkman, an analyst at JPMorgan with an overweight rating, predicted in a note that investors eventually will warm to BorgWarner’s strategy as it wins more contracts to supply electrified products.

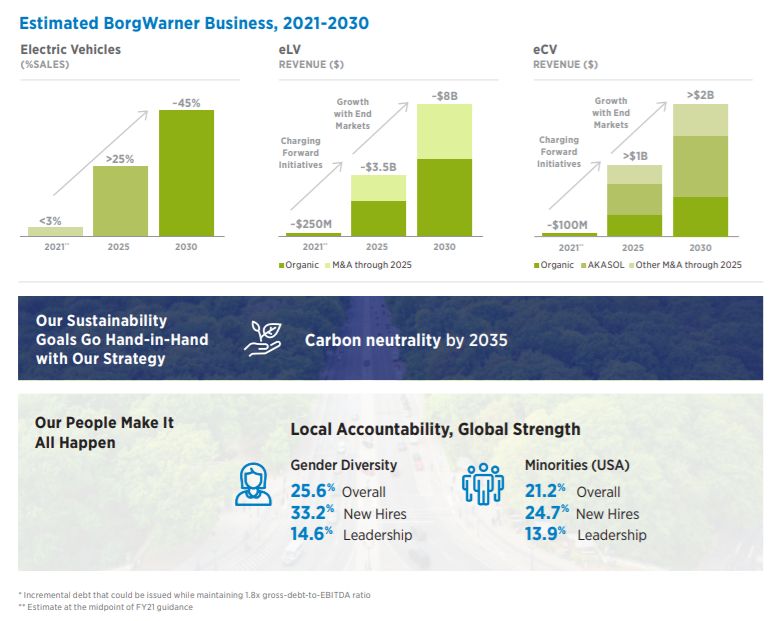

The company said it aims to boost revenue generated from EVs to about 45% of the total by 2030, up from the current 3%. It also will spend around 30% of its R&D total budget on electrification-related technology this year, raising that to almost 50% by 2025.

But those goals are less ambitious than Ford’s decision to double spending on EVs through 2025, GM’s pledge to go all-electric by 2035 and VW’s plan to build six car-battery factories.

As part of its repositioning, BorgWarner intends to sell off parts of its internal combustion engine business that generate between US$3 billion and US$4 billion in revenue, Nowlan said.

It plans to make up for that - at least in part - by acquiring electrification-related business that can generate US$2 billion to US$3 billion in revenue.

The CFO shrugged off the share price drop, saying the company’s margins and financial performance have been strong.

“We don’t get hung up on the one day movement,” he said. “It is really about driving long-term value.”