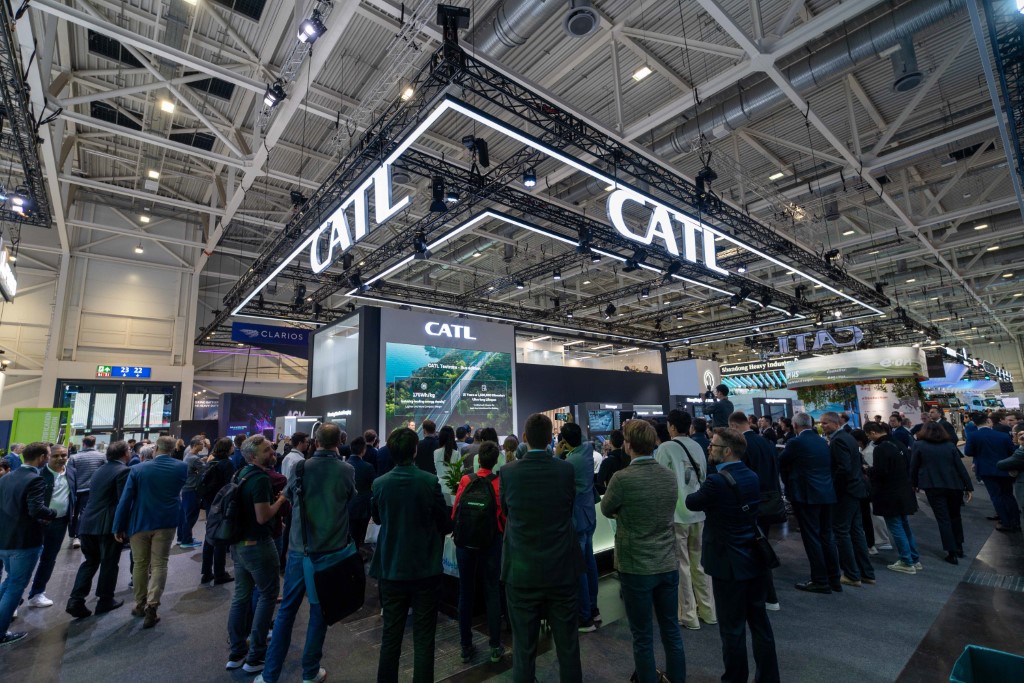

CATL to post record profit

By BLOOMBERG | 10 March 2025

HONG KONG: Contemporary Amperex Technology Co Ltd already offered a peak into a record performance last year, with investors awaiting more details of its upcoming Hong Kong listing which could raise more than $5 billion.

The so-called "Bright 8" share sale, an apparent nod to a lucky number in Chinese culture, is expected to be the biggest listing in the city since 2021, with bankers rushing to get a slice of the multibillion-dollar deal.

CATL, the world's top electric-vehicle battery maker, already flagged net income is likely to jump as much as 20% last year.

Electric vehicle demand is also boosting competition, and Li Auto Inc.'s feeling the squeeze. Quarterly revenue growth is seen down in the single digits, estimates show, though Bloomberg Intelligence said the picture's brighter ahead.

China vows to support the extensive application of large scale AI models, including intelligent connected new energy vehicles, according to the government's annual work report unveiled last week.

Progress on Hon Hai Precision Industry Co.'s $900 million investment in a Mexican assembly plant for servers powered by Nvidia Corp.'s AI chips will show how the Taiwanese conglomerate more commonly known as Foxconn is navigating increasingly complicated trade relations in North America.

Earlier, Taiwan Semiconductor Manufacturing Co. announced plans to invest an additional $100 billion in US plants to boost its chip output on American soil.

CATL's (300750 CH) full-year net income is expected to be at least 49 billion yuan ($6.8 billion), while revenue may be between 356 billion yuan and 366 billion yuan, according to a preliminary statement.

The battery maker recently signed a pact with Baidu on AI application and autonomous driving.

Tags

Autos CATL

Reviews

First drive with the 2025 Hyundai Tuscon and Santa Fe: Seoul...

5.8

Kymco AK550 Premium: Smart easy rider

BYD Seal 6 Premium: Sweet deal, generous kit, sensible prici...

8.7

Mazda CX-80 2.5G PHEV AWD High Plus: Upmarket upgrade

Proton X50 Flagship: Tuned for success

6.6

Triumph Trident 660: Beautifully balanced package

8.4

Mercedes-AMG GLA 35 4Matic: Never a dull moment

Lamborghini Urus SE: Ultimate control

Videos

Free & Easy Media Test: Latest Proton X50 Flagship to Kuanta...

Zeekr Space Sunway City Video

Honda Civic Type R Ultimate Edition: Last 40 Units for Europ...