OVER the past few months, the Wuling Bingo name has started popping up in Malaysian conversations, from car groups to cafe chats.

Most people recognise the cute Chinese electric hatchback; far fewer know who builds it, what the brand stands for, or whether it is here for the long haul.

That question matters because the Bingo is due to launch in Malaysia this month, pitched as an entry ticket into EV ownership for the masses.

Behind it sits SAIC-GM-Wuling (SGMW), a three-way joint venture between SAIC Motor, General Motors and Guangxi Automobile Group (formerly Liuzhou Wuling Motors), formed in 2002 and now one of China’s biggest carmakers with more than 30 million vehicles produced.

All three partners are active beyond SGMW: SAIC and GM mainly through other passenger-car joint ventures and brands, Guangxi Auto primarily in commercial vehicles and components.

To help Malaysians put a face to the name, SGMW and its Malaysian partner TQ Wuling recently brought a group of local media to Liuzhou, the joint venture’s hometown in Guangxi Zhuang Autonomous Region in southern China, which borders northern Vietnam.

Considered a Tier 3 city, Liuzhou is anything but small in industrial terms.

It is an automotive stronghold anchored by SGMW and Dongfeng Liuzhou Motor, plus steel, machinery and food industries.

Dongfeng’s Forthing brand, which is set to enter Malaysia, is built here, and its compact Box EV has already made its debut in the local market.

Like many cities with a dominant carmaker, Liuzhou owes much of its modern growth to the factories humming within its borders.

Crucially, the visit was not about a single showpiece building.

The Malaysian contingent spent the day shuttling between several SGMW sites clustered in Liuzhou’s automotive belt.

One stop was a crash facility, where a compact Wuling model took a side impact test for an export market, side curtain airbags deploying at moderate speed as the doors crumpled in a controlled arc.

Another was a vehicle assembly plant built around SGMW’s headline-grabbing “intelligent island-style” manufacturing system.

There were also dedicated halls for electric motor and battery pack production, a battery R&D centre and an NVH lab.

The island-style line is the technical star of the cluster. Instead of one long conveyor dragging every car through the same sequence, SGMW uses modular work islands linked by autonomous trolleys that follow QR codes on the floor.

Bodies, drivetrains and interiors move between islands as needed, allowing various electric car models to be mixed on the same line with quick changes between batches.

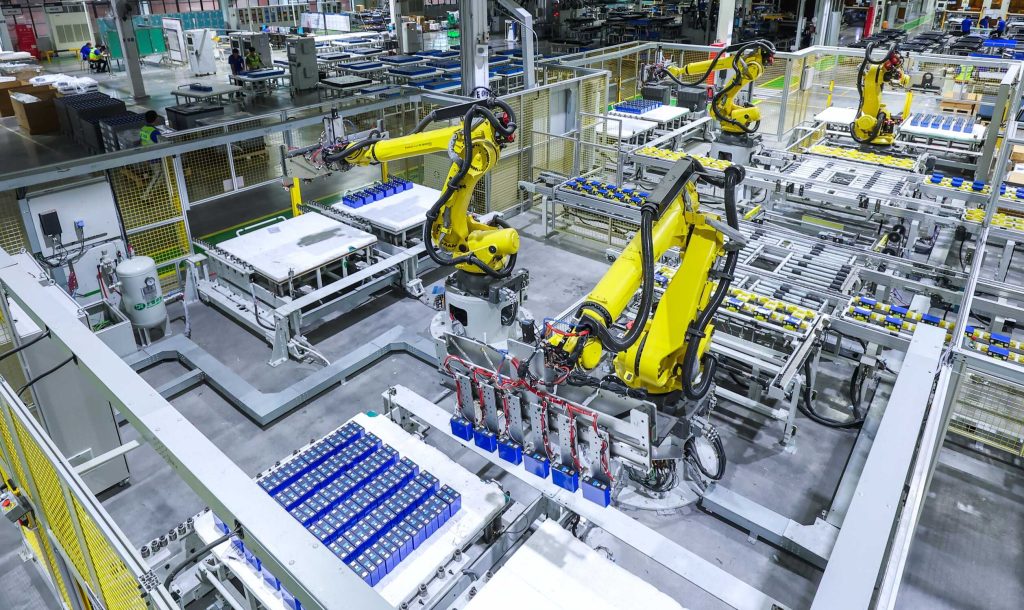

Robots handle the heavy welding, lifting and repetitive jobs, while people still take care of the fiddly work such as wheel-arch cladding, hidden fasteners and trim alignment.

Battery technology sits at the heart of the Liuzhou operation.

In one plant, workers assemble traction packs and electric motors to meet surging demand.

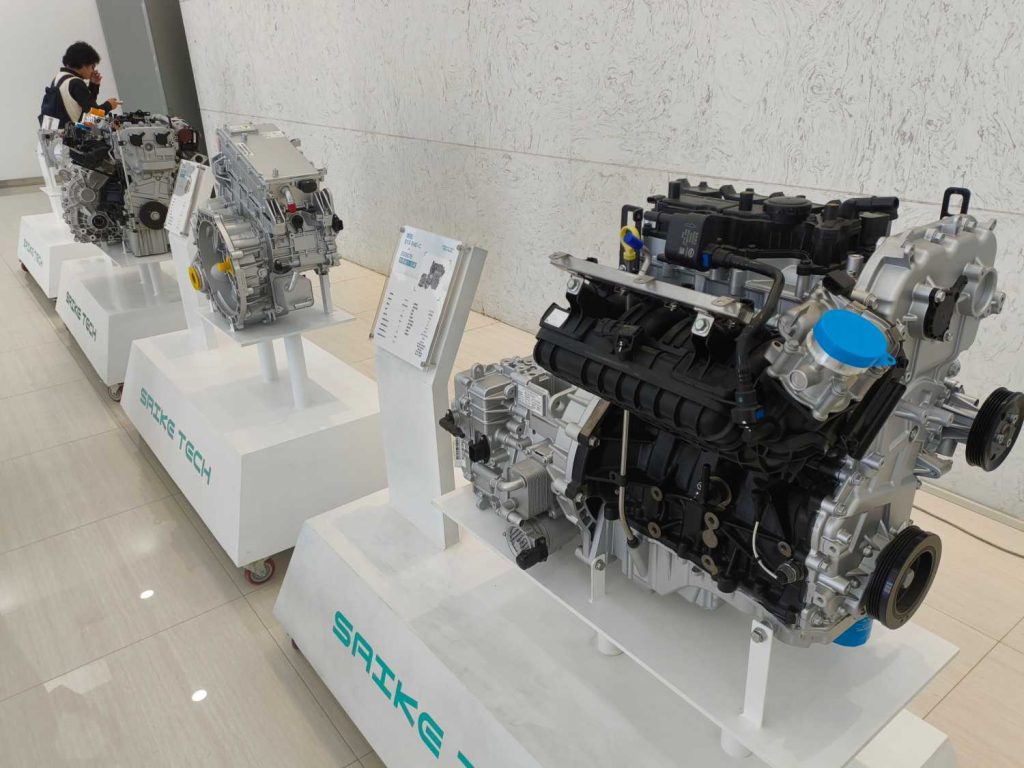

In another, engineers walk visitors through Wuling’s Magic Battery concept, the result of 15 years in the new energy field.

The pack uses a reinforced structure inspired by aircraft wings, designed to protect against impacts and rough-road strikes, and carries an IP68 rating for water and dust resistance.

The torture tests are blunt.

Packs are baked at high temperatures, shaken on rigs, immersed, hit from below and subjected to multi-angle nail penetration, all aimed at preventing thermal runaway.

Wuling talks about “Five Zero” safety: no fires, no intrusion, no water ingress, no propagation and no leakage.

That hardware is backed by a cloud-based AI battery management system, applied across millions of vehicles, which tracks pack health, flags anomalies early and feeds those lessons back into future designs.

Within the complex, the Guangxi New Energy Vehicle Laboratory pulls the technical threads together.

Engineers pore over banks of screens, processing data from crash labs, battery tests and road use.

The NVH lab works on noise and refinement, while aero work is farmed out to external wind tunnel contractors rather than building one in-house.

For visiting media given only a few hours on site, it is a whirlwind overview rather than an in-depth look, but the scale and integration of SGMW’s Liuzhou base come through clearly.

This is a mature operation that has been refined over more than two decades, not a fledgling automotive start-up.

For Malaysia, the bigger story is how this cluster feeds into Asean.

SGMW already runs plants in Liuzhou, Qingdao, Chongqing, Indonesia and Thailand and exports to over 100 markets.

Its regional plan uses Guangxi as a bridgehead into Southeast Asia, with Indonesia, Thailand and soon Malaysia forming a production triangle.

Indonesia builds the Bingo, sold there as the BinguoEV, and Thailand first received it as Indonesian CBU imports before switching to its own local assembly this year.

In Liuzhou, executives spoke of future MPV and SUV models being assembled in Malaysia by TQ Manufacturing for both local buyers and neighbouring countries.

TQ Wuling itself rests on familiar ground for Malaysians.

Tan Chong has nearly 70 years of vehicle assembly experience in Malaysia and has produced more than a million units at its ISO-certified Segambut plant in Kuala Lumpur, alongside its newer Serendah facility in Selangor.

The Segambut plant is less automated than Serendah’s, which actually suits the early stages of Wuling’s rollout because it allows engineers to fine-tune specifications and quality for Malaysian conditions before volumes ramp up.

The Bingo will be the first test. Malaysian-spec cars are set to receive six airbags, four more than early Indonesian and Thai versions.

Driver-assistance features would raise the appeal of the sub-RM100K model.

Insiders hinted that pricing would “be comparable” with the Proton e.MAS 5, which has already reset expectations for an affordable EV.

For a car called Bingo, the numbers behind it are anything but a game.