Tan (left) and Chew.

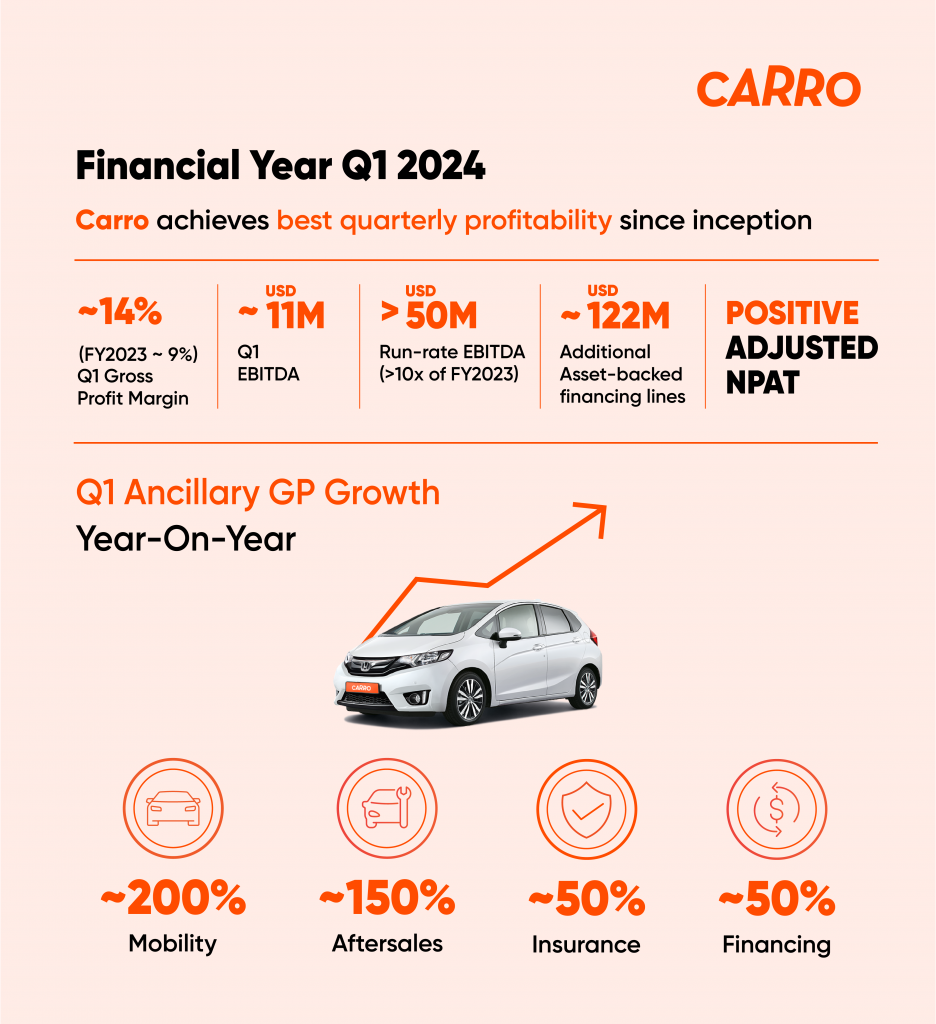

KUALA LUMPUR: Carro, myTukar’s parent company and an online used car platform, has clocked its highest earnings before interest, taxes, depreciation, and amortisation (EBITDA) of over US$4 million (RM18.6mil) for June.The Singapore-based company also exceeded profitability targets for the first quarter of its 2024 financial year (Q1 FY2024).

"Our focus on fundamentals and our reluctance to enter into subsidy wars has enabled us to deliver four quarters of positive EBITDA. The strong execution of our digital ecosystem-led business model has made our business fundamentally stronger and more resilient, with significant ‘sticky’ recurring ancillary income streams," said Carro co-founder and CEO Aaron Tan.

EBITDA is an alternate measure of profitability to net income. By excluding the four parameters, EBITDA aims to represent cash profit made by the company’s operations.

"Ancillary attachment rates are going up as we focus more on our platform flywheel. The investment from Jardine C&C will help us drive even more earnings growth, particularly from aftersales. Our insure-tech partnerships with ZA Tech and MSIG are bearing fruits, with gross written premium growing nearly 100% year-over-year,” said Tan.

Carro earlier announced plans to enter into Japan and other markets.

“With strong cash flows and no operational burn, we made a strategic decision to expand into new markets this year - this will ensure stronger growth for Carro in the years ahead,” said Tan.

"Carro has bucked the industry trend and performed well in the first quarter with profitability metrics up across the board," said Carro chief financial officer Ernest Chew.

"Our first quarter EBITDA is already more than 3 times of our entire last financial year and we continue to be EBITDA positive in all core markets. Ancillaries continue to represent nearly 60% of our gross profit, so we're under no pressure to sell more just to meet profitability targets.

"Our marketplace business, which contributes nearly 85% of our revenues, has doubled gross profit margins over the last 12 months. Gross profit for mobility grew nearly 200%, aftersales grew over 150%, whilst financing and insurance grew about 50% each year-over-year. We expect explosive earnings growth in the near term. We are one of very few profitable tech start-ups, not just in Asia, but globally as well.”