US battery makers will make more than the country needs

By BLOOMBERG | 30 August 2025

LOS ANGELES: US battery makers will likely face a major surplus in manufacturing capacity by 2030 as President Donald Trump's administration withdraws support for electric vehicles, according to a new report.

The US is forecast to deploy nearly 378 gigawatt-hours of batteries by 2030, BloombergNEF said in a report, 56% lower than the group's forecast issued before Trump took office.

It means the country's battery makers face a looming overcapacity issue with 193 gigawatt-hours of batteries capacity online already and an additional 428 gigawatt-hours likely to be built out by 2030.

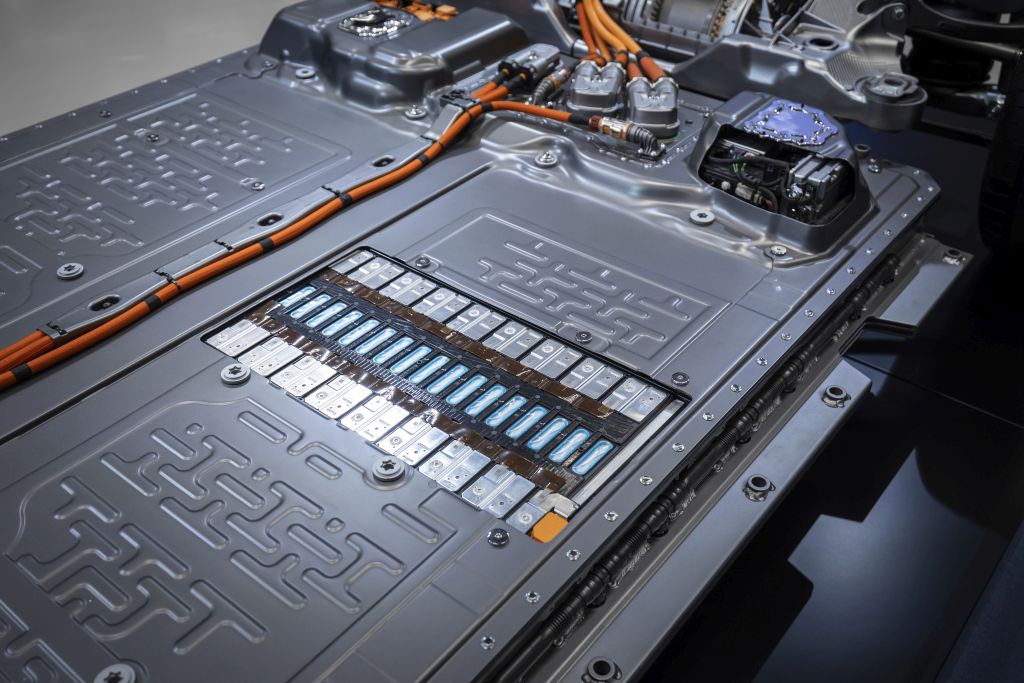

Batteries are a key component for electric vehicles, a segment that grew rapidly under the Biden administration.

But with the Trump administration rolling back federal incentives and phasing out tax credits for EV purchases, demand is expected to slow.

With 14 million fewer EVs expected to be sold in the US through 2030, that will be a hit to battery manufacturers.

"Stable regulatory support still matters for EV adoption," says Matthew Hales, a BNEF analyst specializing in trade and supply chains. "President Trump has taken a wrecking ball to that support."

Meanwhile, battery makers are at risk of losing another type of buyer: power companies.

Utilities in recent years have deployed large-scale batteries to avoid blackouts and store excessive output generated by renewable energy sources.

Virtually non-existent a decade ago, utility-scale battery installations in the US reached a total of 26 gigawatts last year.

In Texas alone, some 4 gigawatts of battery capacity - enough to power around 3 million homes - switched on in 2024.

But the Trump administration has announced rules that push energy storage project developers to steer clear of Chinese battery materials and components in order to qualify for tax credits, which will be hard for the industry.

China dominates the global trade of battery components, with 88% of the world's cathode and 96% of anode production capacity in 2024, according to BNEF.

"These criteria may yet prove unworkable or challenging, dragging down new additions to energy storage in the US," Hales says.

The projected surplus may not fully materialize, though. A growing number of battery makers have put their manufacturing plans on hold or scrapped projects entirely since Trump took office.

Kore Power Inc. abandoned its battery plant plans shortly after Trump was sworn in.

Amprius Technologies announced in May that it wouldn't move forward on a US$190 million (RM803mil) battery plant in Colorado.

Automaker Stellantis has also called off its plan to build an Illinois battery plant.

Shrinking demand combined with collapsing government support for clean tech, will likely lead to more factory cancellations, Hales says, calling it "a poison pill for US manufacturing hopes."

Tags

Autos News

Reviews

First drive with the 2025 Hyundai Tuscon and Santa Fe: Seoul...

5.8

Kymco AK550 Premium: Smart easy rider

BYD Seal 6 Premium: Sweet deal, generous kit, sensible prici...

8.7

Mazda CX-80 2.5G PHEV AWD High Plus: Upmarket upgrade

Proton X50 Flagship: Tuned for success

6.6

Triumph Trident 660: Beautifully balanced package

8.4

Mercedes-AMG GLA 35 4Matic: Never a dull moment

Lamborghini Urus SE: Ultimate control

Videos

Free & Easy Media Test: Latest Proton X50 Flagship to Kuanta...

Zeekr Space Sunway City Video

Honda Civic Type R Ultimate Edition: Last 40 Units for Europ...